Many businesses want to offer digital banking features, like instant payments or simple account management, but building your own bank is hard. Traditional banks require a banking license, and strict rules make it expensive and slow to add new financial services.

I know this struggle, I’ve seen companies spend months trying to launch basic payment processing or other banking products, only to get stuck on regulatory compliance or high costs.

In fact, custom-built solutions can cost up to $1 million and take almost a year, but Banking-as-a-Service (BaaS) cuts both time and price by letting you connect directly with licensed banks through application programming interfaces (APIs).

This guide will explain what BaaS means for your business in straightforward terms, how it works, who the main players are (like challenger banks and white-label providers), why embedded finance matters now, plus tips on choosing the right financial infrastructure partner for your needs.

Banking-as-a-Service (BaaS) is changing how digital businesses deliver financial services, no need to build a full banking infrastructure or hold a banking license.

This guide breaks down the basics of BaaS, explores its advantages, highlights important factors for successful deployment, and shares practical examples for inspiration. Companies can use BaaS to introduce new banking products like debit cards, payment processing, or account management quickly.

These tools unlock fresh revenue streams and boost customer loyalty by making the customer experience smoother.

Understanding Banking-as-a-Service (BaaS)

Suppose your business wants to offer online payments, accounts, or even credit cards straight from your website or app.

Banking as a service (BaaS) shifts this entire process almost overnight. With BaaS, licensed financial institutions share their core systems by way of APIs (application programming interfaces).

This lets fintech companies and other businesses embed digital banking services such as payment processing or account management right into their platforms.

This approach allows businesses to quickly integrate financial products without building everything internally or securing complicated licenses.

BaaS fits within the expanding movement toward embedded finance. Today, more apps include financial features directly within customer experiences, from cash apps to subscription-based platforms. According to a report by Lightyear Capital, embedded finance is projected to generate $230 billion in revenue by 2025, a significant increase from $22.5 billion in 2020.

How Does BaaS Work in Practice?

The banking as a service (BaaS) ecosystem usually brings together three main participants who collaborate closely:

- Licensed Banks: These regulated financial institutions supply the core banking infrastructure, manage required banking licenses, and handle regulatory compliance. They also oversee the main financial products and services being provided.

- BaaS Technology Providers: These companies deliver a technology layer using APIs and developer tools that link digital businesses to the bank’s infrastructure. They simplify integration with cloud-hosted banking systems using user-friendly interfaces for developers.

- Businesses: Companies like yours integrate embedded finance capabilities into their own offerings, adding value for end-users. In this business model, these organizations may also be called “distributors” within the BaaS structure.

This process usually works in the following way:

- A customer accesses your internet banking app or website and starts a financial task such as payment processing or checking account management.

- Your digital platform connects through APIs from the BaaS provider to access services like open banking, deposit protection, or financial infrastructure support.

- The licensed traditional bank processes transactions behind the scenes, taking care of regulatory rules, including privacy directives.

- Your customer enjoys seamless digital banking experiences on your platform without needing to switch between providers or apps.

This three-layer business model lets each participant concentrate on its strengths: banks focus on compliance and infrastructure; technology providers design accessible API connections; businesses improve customer experience while expanding revenue streams with new financial services, driving retention, and building customer loyalty along the way.

Key Banking Services Available Through BaaS

Core Banking Functions

- Account Management: Open and oversee customer bank accounts with comprehensive control.

- Payment Processing: Handle payments (receiving, sending, or managing different transaction types) using integrated financial infrastructure.

- Bank Account Issuance: Deliver white-label accounts featuring all the functions of standard bank accounts under your own branding.

- Card Issuance: Issue branded debit or credit cards, physical or virtual, that connect directly with managed accounts for seamless payment services.

Advanced Financial Services

- Lending Infrastructure: Provide loans, and credit lines, and use underwriting models so customers access financing when needed.

- Identity Verification: Authenticate customers through automated processes to ensure compliance with regulatory requirements like anti-money laundering laws and the Payment Services Directive.

- Compliance Management: Maintain regulatory compliance across multiple regions using advanced software platforms that track changing requirements such as banking secrecy and deposit protection rules.

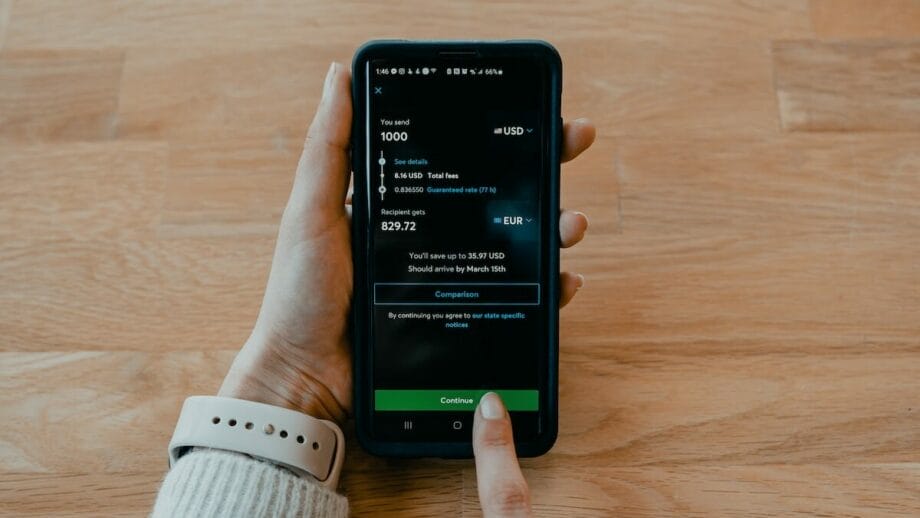

- Currency Exchange: Enable cross-border business by offering foreign currency exchange for international transactions through open-banking connections.

- Digital Wallets: Launch custom payment wallets embedded in your applications for fast, secure digital transactions supporting financial inclusion initiatives.

Data and Intelligence

- Financial Data Analysis: Access real-time transaction data (analyze spending patterns using artificial intelligence and predictive analytics) to make informed decisions about product strategy or customer loyalty programs.

- Risk Assessment Tools: Leverage machine learning-based tools to measure client creditworthiness or flag risky activity before issues arise.

- Fraud Detection: Secure systems against misuse by deploying advanced fraud monitoring powered by learning technologies and intelligent application programming interfaces (API).

A 2023 analysis from McKinsey & Company estimates embedded finance powered by BaaS could reach $7 trillion globally. This figure points to massive opportunities ahead for digital banking providers to transform how companies deliver financial products directly within their platforms.

Why BaaS Matters for Digital Businesses?

1. Reduced Time-to-Market

Developing financial infrastructure from the ground up often requires years of work and millions in funding. Banking as a Service lets you roll out new digital banking products within weeks or months.

Take a fintech company as an example, building direct banking partnerships and linking to core systems usually demands 8-12 months of integration. By using BaaS solutions, companies can achieve similar functionality in just 6-8 weeks, speeding up market entry considerably.

2. Lower Development Costs

Creating custom banking technology calls for specialized professionals and large investments. Typical costs with conventional banking integration include:

- Building a compliant payment processing platform: $500,000-$1 million.

- Ongoing regulatory compliance setup and support: $200,000+ annually.

- Setting up security infrastructure: $300,000+ upfront plus recurring expenses.

BaaS platforms deliver ready-to-use financial infrastructure at much lower costs. These options usually offer subscription plans or transaction-based pricing that flexes with your business needs.

3. New Revenue Streams

BaaS empowers businesses to earn income through various methods:

- Transaction Fees: Earn revenue from processing payments, transferring funds, or managing currency exchanges.

- Subscription Models: Provide premium digital banking features for monthly payments.

- Earning Interest: Receive interest on client deposits or account balances.

- Add-On Services: Offer budgeting tools, spending analytics, or exclusive financial products.

- Cross-Selling Options: Use customer data insights to suggest additional services or products relevant to their needs.

4. Enhanced Customer Experience

BaaS helps keep users engaged by fulfilling financial tasks within your digital environment, streamlining how they interact with your brand:

- No need for customers to juggle between your platform and outside banks for transactions or account management.

- You provide consistent branding and user journeys across every step of the process.

- Your business collects important insights about customer behaviors and preferences related to finances and spending habits.

- This allows you to personalize financial services based on the specific needs of each group you serve.

5. Regulatory Compliance Support

The finance sector enforces strict regulations that shift depending on location and service offerings. When partnering with established BaaS providers, much of this compliance load is handled by the provider:

- KYC/AML Checks: Know Your Customer rules plus anti-money laundering monitoring come built-in.

- Data Security Regulations: Payment Card Industry Data Security Standard (PCI DSS) is included in most setups for payment data safety.

- Laws Protecting Consumers: Adherence to fair lending practices and full disclosure requirements is managed by the provider.

- Coping With International Laws: Providers help comply with cross-border regulatory demands for different regions.

A study by Deloitte shows that financial organizations typically spend around 10-15% of their operating budgets handling compliance tasks. BaaS reduces much of this cost when non-banking businesses add financial services to their offerings.

Who Can Benefit from BaaS?

Banking as a Service extends its advantages far beyond fintech companies. Virtually any digital business can use these banking products to expand its services and increase value for customers. Here are several industry examples:

E-commerce Platforms

- Provide branded payment processing solutions, reducing transaction fees for both shoppers and sellers.

- Add buy-now-pay-later options directly at checkout, without sending users through external providers.

- Roll out savings features that connect with purchases, encouraging repeat shopping.

- Launch customer loyalty programs using integrated financial rewards like cashback or instant credits.

- Offer vendor financing so suppliers can grow inventory and meet demand quickly.

SaaS Companies

- Build subscription management and billing tools right into your software; no need for outside platforms.

- Add expense management features, giving business clients more control over finances in one dashboard.

- Create built-in vendor payment tools to simplify accounts payable within your platform.

- Develop unique industry-focused financial products customized for your customers’ workflows.

Gig Economy Platforms

- Send instant payouts to freelancers after each completed job, with no waiting periods required.

- Deliver specialized banking services developed specifically for contractors and gig workers.

- Add tools that track expenses related to gig work, improving tax-time accuracy and efficiency.

- Automate tax withholding and reporting, simplifying financial compliance for independent workers.

Marketplaces

- Simplify escrow management for large or sensitive transactions with secure bank-backed solutions.

- Allow split payments between several vendors at checkout, supporting complex order fulfillment models.

- Create flexible financing programs so buyers can make larger purchases without upfront strain.

- Add support for cross-border payments and currency exchanges, giving access to international markets more easily than ever before.

Research by Plaid shows that 88% of organizations offering embedded finance solutions report greater customer engagement. Also, 85% experience an increase in revenue streams after implementation.

Implementing BaaS: Getting Started

To successfully introduce banking as a service into your operations:

1. Define Your Financial Strategy

Before reaching out to the bank as a service provider, clarify these points:

- Identify which banking products and financial services will add value for your clients and fit your business model.

- Pinpoint the specific challenges you want to solve for your audience.

- Consider how digital banking features or payment processing will work with what you already offer.

- Outline both immediate and future goals for embedded finance solutions.

2. Choose the Right Partner

BaaS partners vary in their offerings. Review these areas:

- Select the exact services, such as account management or open banking integration, that align with your objectives.

- Check if their platform covers your target markets and addresses regulatory compliance obligations, including deposit protection or banking secrecy where required.

- Ensure compatibility between their technical infrastructure, APIs, and your software systems.

- Evaluate their pricing model for subscriptions or transaction fees, scalability options, and flexibility as you grow.

- Assess available support channels, details of service level agreements, and evidence of secure technology practices.

- Review the provider’s experience handling financial infrastructure securely and reliably for similar businesses or fintech companies.

3. Plan for Integration

Your development team should understand these factors:

- The structure of application programming interfaces (API), documentation quality, and development steps required by platform banking providers.

- Create realistic schedules for implementation phases, from coding to testing white-label banking solutions before launch.

- Categorize resources needed: engineering time, third-party tools like UML diagrams, or open-source software libraries that accelerate integration.

- Pursue user-centric design so customers find digital financial tools intuitive within your existing environment, whether desktop computer programs or mobile apps linked to ATMs or other channels.

- Treat data privacy requirements seriously; outline clear policies on customer information stored by any BaaS partner under applicable laws like GDPR or CCPA if relevant to your region.

4. Address Compliance Requirements

Banks handle much of the regulatory load; still, keep these pieces in check:

- Delineate which responsibilities remain yours, with attention given to disclosures about trademarks used in offering new services inspired by Stripe Treasury or other well-known fintech brands.

- Create easy-to-understand statements about customer rights under deposit protection rules.

- An understanding of all data privacy regulations that impact users’ financial profiles is critical.

- Create internal processes for periodic compliance reviews; maintain up-to-date reporting whenever rules change.

5. Start Small and Scale

A gradual rollout ensures better outcomes:

- Pilot essential features such as payment processing with a focused group before expanding functional coverage.

- Elicit user feedback early through embedded analytics, and refine offerings based on real customer experience rather than assumptions.

- Add capabilities incrementally as each stage proves successful within your revenue stream framework.

- This careful approach helps confirm viability while managing risk at each phase of growth.

How BaaS is Transforming Industries: Real-World Applications

- Retail and Consumer Goods: Leading retailers are adding digital banking services to strengthen customer loyalty. Walmart now provides checking accounts, payment processing, and money transfers right alongside its main retail offerings.

- Ride-Sharing and Delivery: Uber gives drivers fast access to their earnings using embedded finance tools found in the driver app. Instant payouts, real-time account management, and easy tracking of expenses help boost satisfaction for drivers while reducing time spent on banking tasks.

- Healthcare: Medical organizations have started using banking as a service infrastructure for patient-friendly billing solutions, such as flexible payment plans for treatments, health savings accounts, and integrated insurance claim management. Flywire has created specialized payment solutions for healthcare that integrate directly with provider systems.

- Real Estate: The property sector benefits from white-label banking within management platforms. Landlords can collect rent digitally, manage security deposits securely under deposit protection rules, and even offer tenants access to financing options thanks to built-in account services.

BaaS Implementation Challenges and Solutions

1. Technical Integration Complexity

- Challenge: Integrating APIs, especially with older banking infrastructure, poses a serious challenge.

- Solution: Begin with a small-scale proof of concept that targets one core feature before broadening your rollout. Select Banking-as-a-Service providers offering detailed documentation, dedicated integration support, and sandbox environments for thorough testing.

2. Regulatory Requirements

- Challenge: Identifying which financial regulations apply can be confusing for many digital businesses stepping into BaaS models.

- Solution: Collaborate with BaaS companies known for their strong compliance backgrounds and seek advice from regulatory specialists early in your planning stage. Organizations like the Fintech Association often provide resources for navigating regulatory landscapes.

3. Ensuring Data Security

- Challenge: Protecting sensitive financial data is non-negotiable when offering embedded finance or payment processing services.

- Solution: Put strong encryption in place alongside secure authentication measures like those provided by NIST while scheduling regular security audits to catch potential vulnerabilities early.

4. Managing Multiple Banking Relationships

- Challenge: Some financial services require working with several banks, an added burden for challenger banks and fintech companies.

- Solution: Use BaaS platforms capable of consolidating different bank partnerships under a single API layer, streamlining both integration work and ongoing account management tasks within your platform banking model.

5. Building Customer Trust

- Challenge: Customers may hesitate to rely on newer platforms rather than traditional banks, especially regarding personal financial transactions or payment processing.

- Solution: Offer clear communication about the security practices in place, display certifications that verify regulatory compliance, and partner with established banks to provide an added layer of credibility, helping increase customer loyalty by maintaining transparency throughout the process.

The Future of BaaS: Emerging Trends

- Specialized Industry Solutions: Providers now offer banking products specifically crafted for individual sectors instead of only delivering general financial services. This approach helps digital companies (from retailers to healthcare platforms) integrate financial infrastructure that meets their unique requirements.

- Enhanced Data Analytics: BaaS operators have started embedding powerful analytics tools, which help businesses turn customer transactions and account management data into actionable insights. Armed with these analytics, firms can shape more personal banking experiences and boost customer loyalty.

- Global Expansion: BaaS adoption is spreading beyond its early strongholds, with providers overcoming hurdles like regulatory compliance and banking secrecy in new countries. This global push enables fintech companies, challenger banks, and other digital players to scale their banking as a platform model worldwide.

- Integration with Emerging Technologies: BaaS providers are weaving in cutting-edge technologies, blockchain for secure payment processing, artificial intelligence for automated risk checks, and even the Internet of Things for smarter embedded finance solutions linked to physical devices.

Companies such as Decentro serve as prime examples by building core infrastructure that helps digital businesses tap into next-generation open banking features. According to Forbes, fintech infrastructure companies are critical to the expansion of embedded finance, providing the technological foundation that makes BaaS possible across industries.

Open Banking and BaaS: Understanding the Connection

Although they are often mentioned side by side, open banking, and banking as a service (BaaS) cover distinct but connected areas in financial technology. Both play critical roles in reshaping digital banking for businesses.

- Open Banking: Open Banking means that traditional banks share financial data with approved third-party providers using application programming interfaces (APIs), always with customer approval.

- BaaS as an Extension: Banking-as-a-Service builds on open banking by delivering actual banking products, not just information sharing.

The World Bank reports that more than 50 countries have adopted open banking regulations. These steps help create the legal and technical foundation needed for BaaS to develop, allowing fintech companies and challenger banks to provide modern financial services worldwide.

Conclusion

Banking-as-a-Service ushers in a major change in how businesses connect with financial services. By using BaaS, digital platforms, large and small, can now deliver banking products that used to be limited to established financial institutions.

If your company wants to add new revenue streams, improve customer experience, or address payment processing needs, BaaS offers flexible tools for launching advanced financial services without high costs or long timelines.

The outlook for banking stretches far beyond brick-and-mortar branches; it’s showing up across digital business channels, wherever customers interact.

For any business aiming to keep pace with today’s digital landscape, getting comfortable with Banking-as-a-Service is moving from optional to essential.

Disclaimer: The content is informational and does not represent financial advice. No sponsorship or affiliate relationship influences these insights. The author is a fintech expert, and the data are sourced from publicly available research and reputable institutions.