Federal Trade Commission report reveals a loss of more than $8 billion in 2022 due to identity theft and fraud. In addition, millions of cases go unreported every year. Those numbers reflect the severe and constant threat of scammers and hackers that could further lead to identity theft and more losses. Cybercriminals are using sophisticated and advanced techniques to gain illicit access to sensitive data in the increasingly digital world, becoming a grave threat to businesses and individuals.

However, identity theft is not unavoidable as there are certain services you can hire and take certain steps to safeguard your identity and personal information. All you need to do is sign up for a reputed identity theft protection service and enjoy peace of mind that any attempt of theft or fraud will be detected early, and in case your identity does get stolen, it will be restored as soon as possible.

As a customer, you should be aware that plenty of identity theft protection services are available, but not all of them are equally good and deliver what they promise. The onus lies on you to choose one of the best identity theft protection services. Let us look at the most professional companies of today’s generation that take a more modern and proactive approach to identity theft protection.

The following identity theft protection services of 2025 are truly the best as they provide a comprehensive range of features and services to ensure the complete security of your identity and personal information.

1. Aura

Aura, powered by AI, is a smart solution offering active monitoring and a holistic approach to protecting personal information and identity. Aura asserts 24/7 expert fraud support, transparent pricing, plus $1,000,000 coverage in case of identity theft. This also comes with an Identity and Account Breach Monitoring system that monitors and alerts you if your identity, passwords, and accounts are compromised on the Dark Web.

Get help with the help of an experienced White Glove fraud resolution team to help you with Identity Restoration and Recovery Assistance services. Additionally, you can also upgrade to the Family Plan which protects the data of your loved ones through Parental Controls and Safe Gaming features. You can try the plans risk-free because of the 60-day money-back guarantee.

2. Norton LifeLock

Norton LifeLock continues to be a winner because of its extensive monitoring capabilities and a million-dollar protection package. You also get constant real-time alerts in case of any suspicious activities, plus round-the-clock credit monitoring. Thus, there is no chance of your personal information being misused because of LifeLock’s top-tier protection plan.

The best part about Norton LifeLock is that it comes in different plans. Hence, you can choose from different plan options including Standard, Ultimate Plus for Individual, and Ultimate Plus for a Couple. While Credit Monitoring is available for all plans, the Ultimate Plus plans have credit monitoring by 3-Bureau. Also, one can get an Alert on Crimes in Your Name feature. Both the Ultimate Plans also cover Social Media Monitoring, Home Title Monitoring, 401(k) & Investment Account Activity Alerts, Buy Now Pay Later Alerts, and Phone Takeover Monitoring features.

3. IdentityForce

IdentityForce, well known for its two-factor authentication plus affordable services, is immensely popular among customers looking for complete protection from identity theft. Comprehensive monitoring based on advanced artificial intelligence can detect potential threats, leaving one feeling completely secure about their digital footprint and personal information.

This TransUnion brand provides a holistic approach to identity and credit protection through robust technology, seamless communication, excellent customer service, and better product testing and development. The system focuses on four main aspects which are Monitor, Alert, Control, and Recover. The Advanced Fraud Monitoring systems ensure real-time monitoring of Change of Address, Court Records, Credit Reports, Dark Web, Payday Loans, and Social Media. The recovery team works to help complete paperwork, make calls, and handle details to restore your identity.

4. McAfee+ Ultimate

McAfee+ Ultimate is already renowned for cybersecurity expertise and is well-established as a digital security company. Its extensive feature list includes a password manager, firewall protection, antivirus software, and a virtual private network. The service also offers dark web monitoring, credit monitoring, and social security number tracking.

If you are looking for the most comprehensive coverage McAfee+ Ultimate covers it all. In terms of security, you get the McAfee Scam Protection, McAfee Protection Score, and Web Protection features. The solution also provides a personal VPN and Social Privacy Manager. You also get Bank Account Takeover monitoring, 3-Bureau Credit Monitoring, and daily score updates.

5. Identity Guard

Identity Guard is trusted by more than 38 million people who rely completely on the identity protection service. A team of experts follows a proactive approach to deliver a personalized service that includes fraud monitoring, 24/7/365 support, credit monitoring, and bank account protection. Identity Guard monitors its digital presence effectively because of its highly skilled fraud remediation agents.

This award-winning identity theft protection allows you to keep your data safe in the best possible ways. The Ultra plan offers the most comprehensive protection which includes $1 Million Identity Theft Insurance, White Glove Fraud Resolution, and many other features. In terms of identity theft protection, you also get Social Media Monitoring, Credit & Debit Card Monitoring, 401K & Investment Account Monitoring, Home Title Monitoring, and Criminal & Sex Offense Monitoring. You also get additional features like the 3-Bureau Annual Credit Report for your reference.

6. IDShield

IDShield combines the power of artificial intelligence with human expertise to deliver a robust identity theft protection service. The service offers continuous monitoring of personal information, including social security numbers and financial accounts. In the event of identity stealing, IDShield offers dedicated support through its team of licensed private investigators, guiding users through the recovery process.

IDShield offers a variety of Individual Plans and Family Plans that ensure peace of mind so that you do not have to worry about restoring all the information to the pre-theft status. IDShield also offers up to $3 million in coverage for lawyers and experts needed to fix identity theft if it occurs. You also get the benefit of staying on top of your finances as you get credit reports from one to three bureaus.

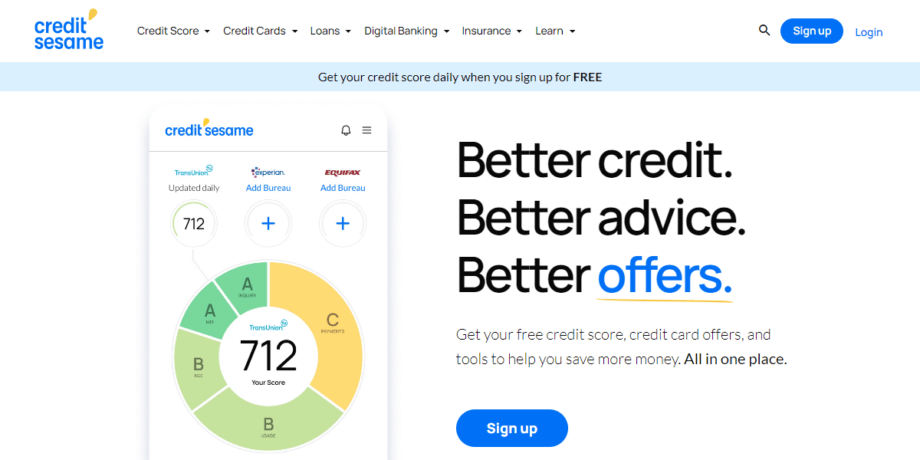

7. Credit Sesame

Credit Sesame can proactively manage your data, information, and credit because of its comprehensive range of advanced tools and features. One can try the free version to satisfy all their requirements and identity monitoring. Take advantage of their premium tools and suggestions for improving your credit score.

Also, you can find a lot of comprehensive data and information on Credit Sesame which works to help you to cut down the time and effort it takes to manage your credit score. Even if you are a novice user you can make use of the simple and easy-to-learn features to help you build your credit as you purchase daily.

8. PrivacyGuard

PrivacyGuard provides daily credit monitoring and alerts because of its comprehensive resources and distinguishes itself by taking swift action to investigate any changes and activity related to your credit. There is a professional team on hand that keeps the users informed about their financial health.

Unlike its competitors, PrivacyGuard focuses completely on offering protection from identity theft, and one can try the service for two weeks before buying the plan. It virtually protects all information including your Date of Birth, Social Security Number, Passport information to credit card details which allow data thieves to sneak further into your details.

9. IdentityIQ

Once you are on the radar of IdentityIQ, you can rest assured that your credit report and non-credit-related information are now in safe hands. You get notified right away in case of any suspicious activity, and the advanced privacy tools and Bitdefender Total Security antivirus software of the system will block any cyberattacks.

With more than $1 million in identity theft insurance, you can now enjoy peace of mind regarding any identity theft. With the rise in AI scams, IdentityIQ is a great option for those who want smarter identity theft security solutions. With their Secure Plus plan, you also get the $1M stolen funds reimbursement.

10. Zander

Zander, as an ID theft protection system, presents some of the most inexpensive plans, which can be surprisingly generous. Those with budgetary concerns should give Zander a closer look. When it comes to protecting your identity for an affordable price, Zander, with its standard features, is certainly among the best identity theft protection services of 2025.

With Zander, you can choose from the two plans that offer you a comprehensive list of benefits you can avail yourself of.

Conclusion

You can choose from any of the identity theft protection systems, based on the level of protection you want and your budget.