Quick Summary

Channel partners are shifting from one-time sales to predictable recurring revenue with cloud services. By selling outcomes instead of SKUs, focusing on a tight cloud portfolio, delivering full-lifecycle services, and using aggregation and automation, VARs and MSPs can scale profit without adding complexity.

Success comes from packaging clear, outcome-driven bundles, optimizing cloud spend over time, and training sales teams to lead with business impact – turning cloud adoption into long-term, high-margin customer relationships.

Introduction

Your customers no longer buy boxes or perpetual licenses. They expect always-on, consumption-based cloud services that deliver clear business outcomes – and they expect them now.

According to Gartner, public-cloud spend will reach $675 billion in 2024, a 20 percent jump from last year. For value-added resellers (VARs) and managed service providers (MSPs) like you, that surge turns one-time margin into predictable, recurring revenue.

This guide shows you how to build – and steadily mature – a focused cloud practice that lifts profit without piling on complexity.

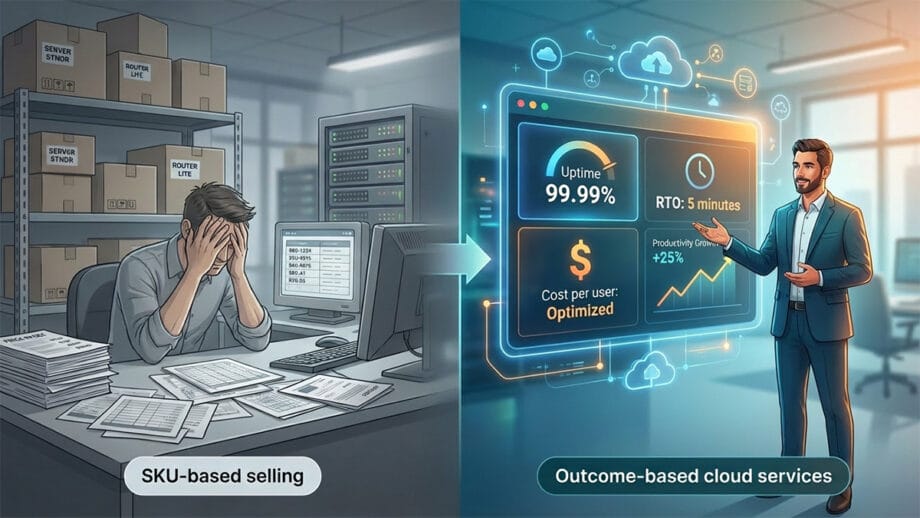

Move from Selling SKUs to Selling Outcomes

For decades, resellers won deals by matching part numbers to price sheets. Today, buyers judge value in business terms: productivity gained, risk reduced, or costs kept predictable. A 2025 EY X-as-a-Service survey confirms the shift: only 27 percent of vendors price purely on outcomes now, yet 30 percent plan to add that model within three years, and more than half already offer usage or consumption pricing.

What does this mean for you as a VAR or MSP?

- Start every conversation with the pain you remove, not the platform you resell. For example: “We cut recovery times for regional hospitals from hours to minutes, so clinicians stay online.”, or “We modernize legacy ERP workloads so CFOs can forecast in real time, without rewriting code.”

- Package services and platform capacity together. An assessment that maps dependencies, a fixed-scope migration, and an optimization retainer become one outcome-anchored offer.

- Prove the result. Commit to metrics the customer cares about – uptime, RPO/RTO, per-user cost – then surface them on shared dashboards each month.

When you frame cloud services as the engine for a promised business result, price fades into the background, and renewals follow naturally.

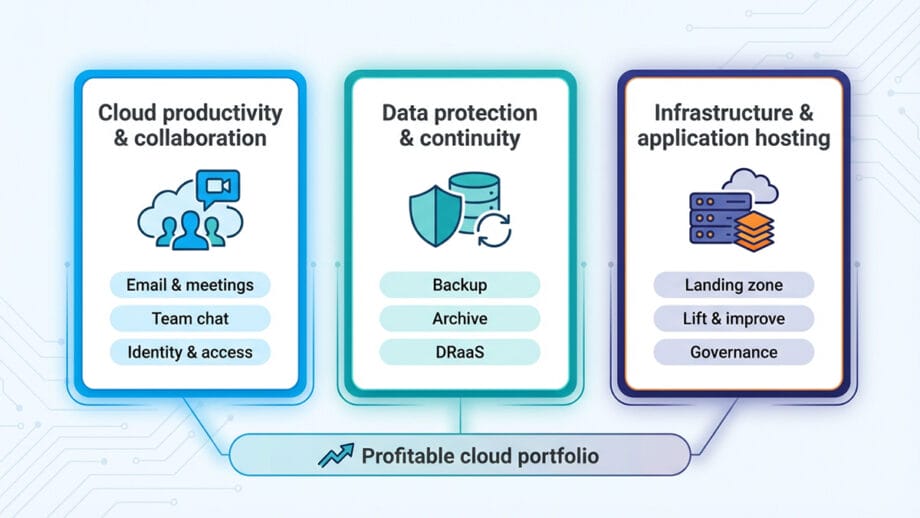

Define a Clear Cloud Portfolio

Trying to cover every possible workload spreads your architects thin and gives your sellers too many options. Market data supports focus: managed cloud services are forecast to grow from US $73.9 billion in 2024 to US $164.5 billion in 2030, with most of that spend clustering around productivity suites, data-protection platforms, and managed infrastructure.

“Partners rank simplified, specialized tech solutions and ease of transacting business among the top factors when they choose a distribution partner, which reinforces how much the channel now values focus over breadth.”TD SYNNEX

For a VAR or MSP, that preference translates into building a small number of clearly defined cloud bundles rather than trying to resell every possible tool. According to Mordor Intelligence, Disaster Recovery as a Service already routes 47 percent of its revenue through fully managed bundles, not self-service tools.

A pragmatic portfolio usually starts with three lanes:

- Cloud productivity and collaboration, such as Microsoft 365 or Google Workspace, are paired with identity management.

- Data protection and continuity, covering backup, archive, and DRaaS from one policy engine.

- Infrastructure and application hosting, delivering “lift and improve” migrations into a governed landing zone.

Capture one standard offer for each lane. Spell out scope, SLA targets, and pricing logic. Note which elements you run versus what a hyperscaler or ISV supplies. When the lines are clear, you can train sellers faster, quote consistently, and scale delivery without cutting margin.

Build Services Around the Cloud Lifecycle

One-off migrations create a quick revenue bump, but full-lifecycle services create an annuity. According to Precedence Research, the global cloud-migration services segment is projected to rise from US $21.7 billion in 2025 to nearly US $198 billion by 2034. A Flexera report finds that 84 percent of enterprises say cloud spend is their top challenge, and budgets run 17 percent over plan, which fuels demand for continuous optimization and FinOps oversight.

A tight lifecycle model keeps your catalog coherent:

- Discover: Baseline the estate, score cloud readiness, and quantify TCO.

- Design: Build a secure landing zone, map dependencies, and confirm cost guardrails.

- Migrate: Move data and workloads against downtime SLAs, with rollback options.

- Operate: Provide 24×7 support, security posture management, and monthly cost-efficiency tuning.

Link each step to a revenue handle: workshops and assessments generate project fees, migrations unlock milestone payments, and Operate secures multiyear recurring revenue. When every engagement points to the next phase, landing the first workload isn’t the finish line; it’s the kickoff to a predictable, higher-margin relationship.

Lean on Aggregation and Automation

Margins shrink fast when every new vendor brings its own portal, price sheet, and support queue. Omdia forecasts that enterprise software sales through hyperscaler marketplaces will climb from US $30 billion in 2024 to US $163 billion by 2030, with more than half of that volume flowing through channel partners. A marketplace pulls quoting, billing, and true-up into one feed, cutting invoice reconciliation time so your sellers can focus on pipeline, not paperwork.

Automation delivers a second, equally important lift. A 2025 ConnectWise case study reports that Decision Digital trimmed ticket-triage time from ten minutes to nine seconds and automated 80-85 percent of inbound tickets, achieving a 38 percent drop in staffing costs. Robotic process automation and policy-driven workflows turn labor into a scalable margin.

Action steps:

- Route as many transactions as possible through one or two trusted marketplaces, and let the platform handle quoting, credit, and true-up.

- Use RPA or workflow engines for high-volume tasks such as user onboarding, patch approvals, and basic monitoring alerts, then redeploy technicians to higher-value architecture, optimization, and advisory work.

When aggregation takes care of the paperwork and automation erases repetition, every new customer adds profit instead of overhead.

Train Your Sales Team for Cloud Conversations

“Ditch speeds and feeds for stakes and impact. Buyers don’t want terabytes; they want uptime, time back, and fewer bad surprises.”McKinsey

Speeds-and-feeds decks rarely win outcome-driven deals. Many partners tell us their reps aren’t ready: Westcon-Comstor’s 2025 Mastering the Maze survey shows 69 percent of channel firms hear customers asking for specialist cloud expertise, yet only 57 percent feel confident they can provide it. Gartner reports that sellers who master solution-focused discovery are 3.7 times more likely to hit quota than those who don’t.

Reframe the playbook:

- Start every call with an impact question instead of a product spec. “What happens if this database is offline for an hour?” steers the talk toward downtime costs, not storage tiers.

- Arm reps with two or three outcome bundles, such as “remote-work enablement” or “rapid recovery,” so they can pivot fast without overwhelming the prospect.

- Translate technical differentiators into business language: recovery-time objective (RTO) becomes “minutes of revenue at risk,” autoscaling becomes “capacity only when you need it.”

Conclusion

When your sellers lead with risk avoided and flexibility gained, and support the promise with crisp bundles, they turn cloud features into recurring value that the customer gladly signs off on.