Guidewire Software Faces Recent Setback Despite Long-Term Gains

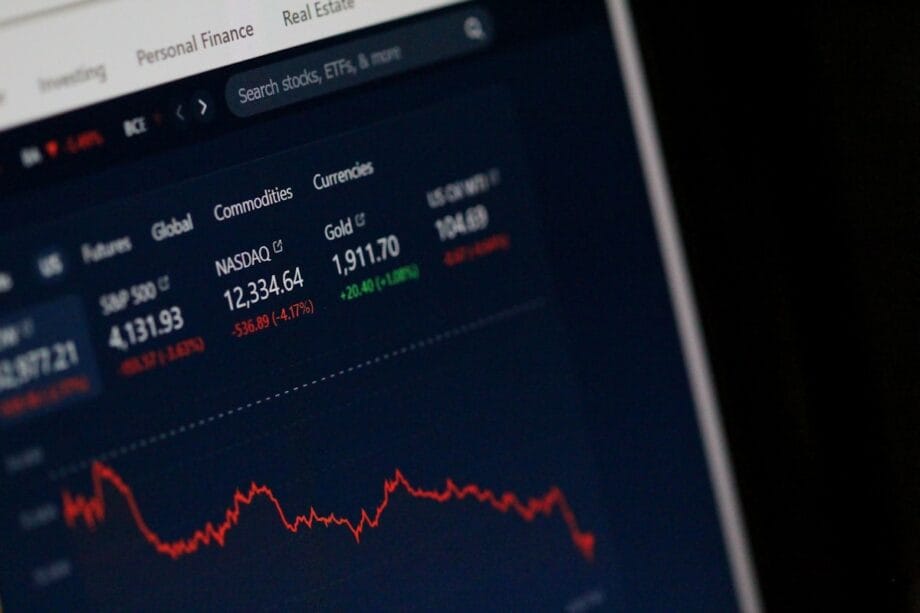

Shareholders of Guidewire Software, Inc. (NYSE: GWRE) may find themselves in a state of measured contentment, yet the stock has experienced a lackluster performance of late, registering an 18% decline over the past quarter.

Conversely, the company’s performance over the last three years has been remarkable, with its share price ascending by an impressive 197%.

Such fluctuations are not uncommon, particularly following significant surges in stock value. The pivotal question remains whether the underlying business can sustain this elevated price point.

Although long-term performance exhibits robustness, the recent dip of 8.7% prompts a deeper examination into whether the fundamentals are commensurate with the current share price.

While Guidewire Software recorded a nominal profit in the past year, the current investor focus appears to be shifting toward top-line growth.

In this context, it would be prudent to evaluate such a stock’s potential alongside those of other companies that may not be profitable, given the relatively minor profit margins.

A sustainable future will likely hinge on the company’s ability to augment revenue streams.

Over the preceding three years, Guidewire Software has achieved annual revenue growth of 13%, a commendable figure indeed.

This steady progress is mirrored by the stock price’s increased value, which has gained 44% yearly on average during that span.

Such development, however, raises questions regarding the anticipated timeline for the company to turn its profits into tangible benefits, marking a potential inflection point for investor interest.

Guidewire Software is well-recognized within investment circles, and many astute analysts have endeavored to forecast future profit trajectories. Therefore, we advocate consulting this free report displaying consensus forecasts.

In the past year, Guidewire Software shareholders have realized a total return of 8.9%, which, while positive, falls short of the broader market return.

Nevertheless, it still trumps the average return of 7% observed over the past five years, indicating potential for the company to attract fresh investors as it endeavors to implement its strategic goals.

While tracking long-term share price performance is pivotal, understanding Guidewire Software necessitates scrutiny of additional variables, including inherent risks.

It is essential to recognize that every enterprise harbors risks, and we have identified two warning signs for Guidewire Software that warrant attention.

Source link: Ca.finance.yahoo.com.