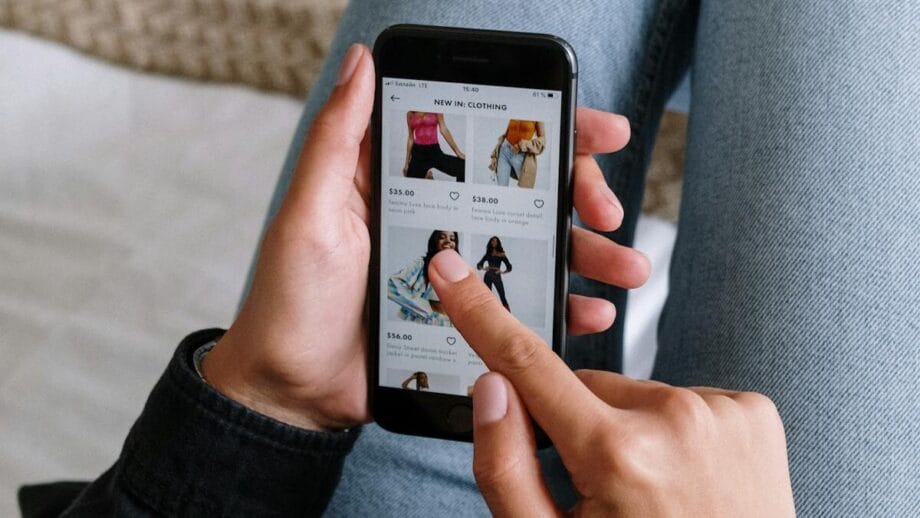

Recent insights from consulting firm Bain & Company have illuminated the meteoric rise of Chinese e-commerce behemoths within the Southeast Asian online shopping arena.

The report indicates that these firms now command nearly half of the e-commerce market in Indonesia, Thailand, and the Philippines.

This notable surge coincides with efforts to extend China’s unprecedented Singles Day shopping festival to international territories.

SHEIN and Temu Dominate Local E-Commerce Hierarchies

The analysis underscores that notable Chinese entities, particularly SHEIN and PDD’s Temu, have captured approximately 50% of the regional e-commerce landscape. Furthermore, their influence extends to nascent online markets as far afield as the United States and Brazil.

These developments emerge amidst an aggressive global expansion strategy by Chinese corporations, set against a backdrop of decelerating domestic economic growth and escalating geopolitical tensions between the U.S. and China.

In addition, the report reveals that Chinese sellers, often excelling in markets characterized by lower online spending capabilities, are pushing boundaries this year.

Notably, Alibaba’s Taobao is broadening its Singles Day promotional activities to encompass 20 regions, signaling a shift from a China-centric focus to a more global perspective, particularly targeting areas where Amazon has entrenched its Black Friday promotions.

Alibaba’s International Unit Reports Impressive Revenue Surge

Alibaba’s “International Digital Commerce Group” documented an impressive 19% year-on-year revenue escalation during the June quarter, achieving ¥34.74 billion (approximately $4.85 billion).

This figure slightly exceeds the revenue garnered by its cloud computing division, yet pales in comparison to Alibaba’s domestic e-commerce sector, which only managed a growth of 10%.

Comparatively, the Chinese e-commerce market dwarfs its American counterpart, with a gross merchandise value of $2.32 trillion versus the U.S.’s $1.05 trillion last year.

Challenges Awaiting Chinese E-Commerce Players in Various Markets

In Southeast Asia, Indonesia stands out with an astounding $62 billion in e-commerce gross merchandise value last year. However, the pathway to expansion is fraught with obstacles for Chinese entities.

In Singapore, Alibaba’s Lazada suffered a contraction in market share to local rival Shopee, while Amazon and Walmart continue to dominate the U.S. marketplace. According to Bain data, non-Chinese e-commerce firms constitute nearly 95% of the market in the United States.

Source link: Newsbytesapp.com.